ABC SA100 Individual Tax Return

Easy-to-use software to submit SA100 Individual Tax Returns

Designed for taxpayers submitting their own tax returns. Also suitable for agents.

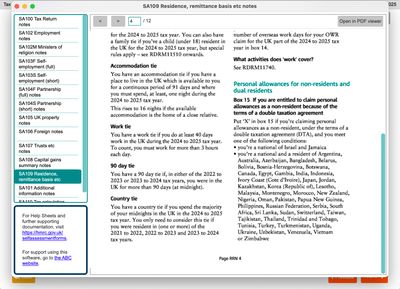

Includes all supplementary forms, including those not available on the HMRC website.

Clear user interface with links throughout to the relevant HMRC guidance notes.

£16.00+VAT to submit for one individual. Bulk discounts are available.

First time? See our guide for first-time Self Assessment users.

Product description

The SA100 Individual Tax Return is the main Self Assessment tax return to notify HMRC of your income as an individual.

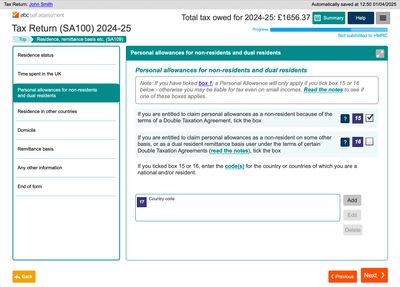

Supplementary forms are used to declare each income source, such as Employment, Self-Employment, UK Property or Foreign income.

Most individuals can submit their SA100 Individual Tax Return via the HMRC online service, which is free. However, the HMRC website does not include certain supplementary forms such as:

- SA109 for UK taxpayers living overseas

- SA102M for Ministers of Religion

- SA107 for individuals with income from a trust

- The SA100 (and supplementary forms) for previous years

ABC SA100 Individual Tax Return can be used to submit any of those cases to HMRC. It has the same questions as the HMRC paper forms, and and displays the forms in a similar manner.

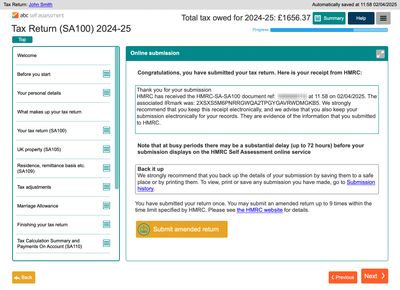

PDF Attachments can be included with the tax return, and amended returns can be submitted.

Price

£16.00+VAT. This allows one individual to submit for one tax year, including amendments.

Try before you buy: you can download and install ABC SA100 Individual Tax Return for free, with no obligation, then fill out your tax return in evaluation mode to check you are happy with the software and the process. Then, when you are ready to submit to HMRC, purchase a licence to enable submission.

Forms included

ABC SA100 Individual Tax Return includes the following supplementary forms:

- Employments (SA102, full and short versions)

- Ministers of Religion (SA102M)

- Self Employment (SA103, full and short versions)

- Partnership (SA104, full and short versions)

- UK Property (SA105)

- Foreign (SA106)

- Trusts etc. (SA107)

- Capital Gains (SA108)

- Residence, remittance etc. (SA109)

- Supplementary information (SA101)

- Tax calculation summary (SA110)

Note that a small number of scenarios are not supported see here.

Tax years available

HMRC change the forms and rules each year, so install and purchase the software for the year you are submitting for.

- Year ending 5 April 2025: Download | Purchase

- Year ending 5 April 2024: Download | Purchase

- Year ending 5 April 2023: Download | Purchase

- Year ending 5 April 2022: Download | Purchase

Earlier years are not available because HMRC only allow electronic submission up to four years after the end of the tax year.

What do I need to be able to submit Self Assessment electronically?

In order to submit a Self Assessment return electronically to HMRC you must have a Unique Tax Reference (UTR) and a Government Gateway ID and password, where that Gateway ID has the Self Assessment service activated for your UTR.

The activation process, also referred to as enrolling for Self Assessment, involves HMRC sending a code in the post, which typically takes 3-5 working days to arrive. When you receive it you need to follow the instructions to enter that code in to the HMRC website to complete the process.

Activation only needs to be done once, so if you have ever submitted Self Assessment before, e.g. using the HMRC website, your Gateway ID will be ready to submit using software such as ours. For details on how to activate Self Assessment see here.

Software system requirements

ABC SA100 Individual Tax Return is available for:

- Windows PC (Windows 10 or newer)

- Mac (OS 10.11 El Capitan or newer)

- Linux, via Wine

It is not available for Chromebook, Android, iPad or iPhone.

Easy to use

Designed for taxpayers submitting their own tax returns. Also suitable for agents.

Recognised by HMRC

We have supplied Self Assessment software recognised by HMRC since 2015.

Windows or Mac

Our software is available for Windows 10 or newer, and MacOS 10.11 (El Capitan) or newer.

Direct to HMRC

Nothing in the cloud - your data is sent securely from your computer to HMRC.