How to activate Self Assessment for a partnership

To submit the SA800 Self Assessment return for a partnership, the partnership must have it's own UTR and you must have a Gateway ID that has the Self Assessment service activated for that partnership UTR. Otherwise, any attempt to submit will be rejected with an Authentication Error (the same error you would see if you typed the password incorrectly).

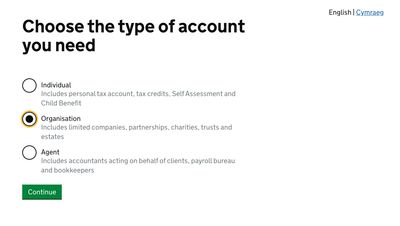

To obtain a Gateway ID for the partnership, go to the sign in page for the HMRC website (https://www.gov.uk/log-in-register-hmrc-online-services) and click 'Create sign in details' then follow the prompts. That will create a fresh government gateway ID (you can create multiple using the same email address without any issue) with a password that you set during the process. After you obtain the gateway ID you can then select a type of account for it - select 'Organisation':

Then, on the Business Summary screen that appears click 'Add a tax, duty or scheme' then 'Self Assessment, including partnerships and trusts' and follow the prompts.

That will trigger HMRC to put an activation code in the post, which typically arrives in about 5 working days. When that arrives, sign in to the HMRC website with the partnership Gateway ID and enter the activation code as instructed, to complete the activation process. You will then be able to submit from ABC SA800 Partnership Tax Return.