ABC SA800 Partnership Tax Return

Easy-to-use software to submit the SA800 Partnership Tax Return

Designed for taxpayers submitting their own tax returns. Also suitable for agents.

Clear user interface with links throughout to the relevant HMRC guidance notes.

Export partnership statements for partners.

Available for years back to 2022.

£22.00+VAT to submit for one partnership. Bulk discounts are available.

Product description

The SA800 Partnership Tax Return is the tax return to notify HMRC of partnership income and disposals.

Supplementary forms are used to declare income from sources such as trades, property or disposals of chargeable assets.

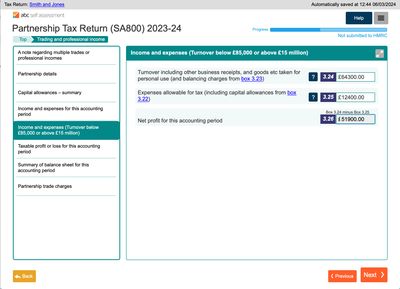

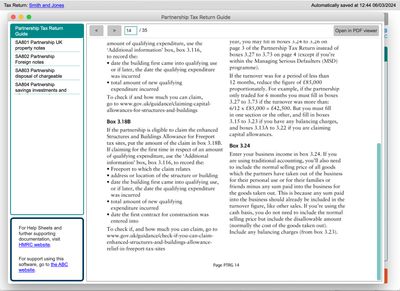

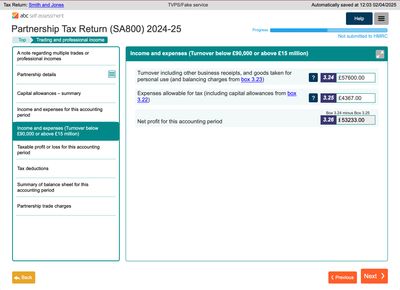

ABC SA800 Partnership Tax Return can be used to submit the SA800 to HMRC electronically. It has the same questions as the HMRC paper forms, and and displays the forms in a similar manner.

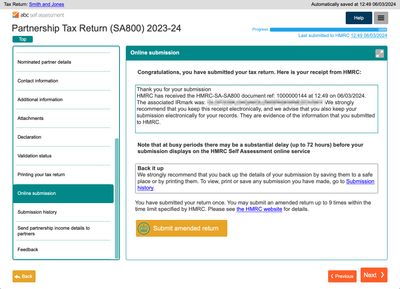

PDF Attachments can be included with the tax return, and amended returns can be submitted.

Price

£22.00+VAT. This allows one partnership to submit for one tax year, including amendments.

Try before you buy: you can download and install ABC SA800 Partnership Tax Return for free, with no obligation, then fill out your tax return in evaluation mode to check you are happy with the software and the process. Then, when you are ready to submit to HMRC, purchase a licence to enable submission.

Forms included

ABC SA800 Partnership Tax Return includes the following supplementary forms:

- Partnership Trading and Professional Income (SA800 TP)

- Partnership UK Property (SA801)

- Partnership Foreign (SA802)

- Partnership Disposal of Chargeable Assets (SA803)

- Partnership savings and investments and other income (SA804)

- Partnership Statement (Full) (SA800 PS)

Tax years available

HMRC change the forms and rules each year, so install and purchase the software for the year you are submitting for.

- Year ending 5 April 2025: Download | Purchase

- Year ending 5 April 2024: Download | Purchase

- Year ending 5 April 2023: Download | Purchase

- Year ending 5 April 2022: Download | Purchase

Earlier years are not available because HMRC only allow electronic submission up to four years after the end of the tax year.

What do I need to be able to submit a Partnership tax return electronically?

In order to submit Self Assessment for a partnership electronically to HMRC the partnership must have its own Unique Tax Reference (UTR), and its own Government Gateway ID and password. The partnership Government Gateway account must have the Self Assessment service activated.

The activation process, also referred to as enrolling, involves HMRC sending a code in the post, which typically takes 3-5 working days to arrive. When you receive it you need to follow the instructions to enter that code in to the HMRC website to complete the process.

For details on how to activate Self Assessment for a partnership see here.

System requirements

ABC SA800 Partnership Tax Return is available for:

- Windows PC (Windows 10 or newer)

- Mac (OS 10.11 El Capitan or newer)

- Linux, via Wine

It is not available for Chromebook, Android, iPad or iPhone.

Easy to use

Designed for taxpayers submitting their own tax returns. Also suitable for agents.

Recognised by HMRC

We have supplied Self Assessment software recognised by HMRC since 2015.

Windows or Mac

Our software is available for Windows 10 or newer, and MacOS 10.11 (El Capitan) or newer.

Direct to HMRC

Nothing in the cloud - your data is sent securely from your computer to HMRC.